What is bitcoin? How does it work?

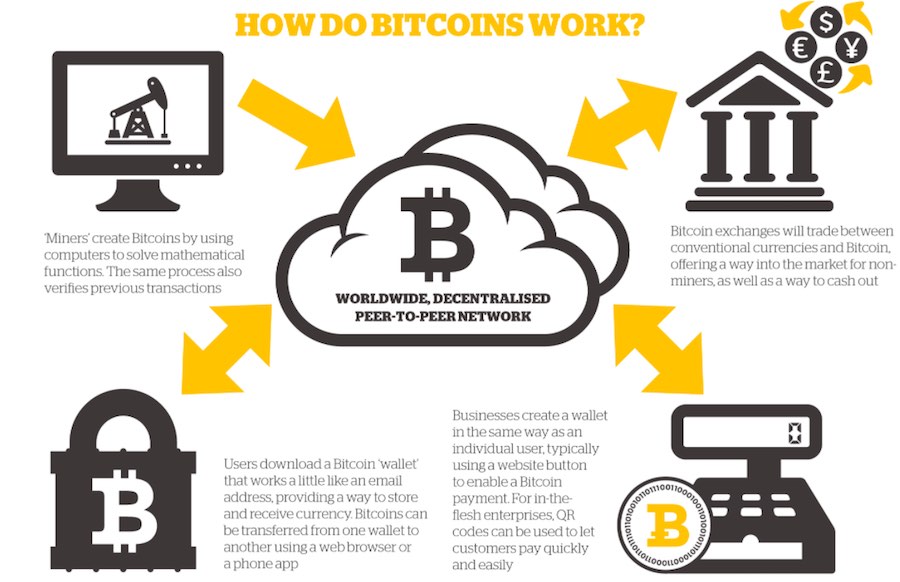

In the simplest form, Bitcoins can be described as a “Peer to Peer Electronic cash system.” Bitcoins can be used as a method of payment for numerous goods and services and for simple transactions like purchasing vouchers, paying bills, etc. In different jurisdictions, Bitcoins are treated as a property, currency, virtual asset, good, security or commodity for the purpose of trading on a stock exchange or commodity exchange.

Essentially Bitcoin is a cryptocurrency,

i.e., it operates on the principles of cryptography to manage the

creation of Bitcoins and securing the transactions. Cryptocurrencies are

managed by private parties, without the need for a government authority

to monitor the currency system. The currency has been designed in a way

that the number of total units of Bitcoins in circulation will always

be limited. Going by the pace at which Bitcoins are being minted, the

last unit will be mined around the year 2140.

Also Read: What Is The Difference Between Deep Web, Darknet, And Dark Web?

The cryptocurrencies essentially work on

the Blockchain system. A Blockchain is a public ledger of Bitcoins that

is designed to record all the transactions. The chronological order of

Blockchain is enforced with cryptography and each new ledger update

creates newly minted Bitcoins. This is designed in a way that Bitcoin

wallets can calculate their total balance and new transactions can be

verified. The integrity and the chronological order of the block chain

are enforced with cryptography.

The buyer and seller can enter into

transactions by using their Bitcoin wallets that are secured by a secret

piece of data called, a “Private key.” The key is used to authorise the

transactions by the owner of the wallet, and cannot be normally

tempered by anyone, once it is issued. The

transactions are performed by adding the Bitcoin wallets on an

exchange, acting as a facilitator for sale and purchase of Bitcoins. All

transactions are displayed between the users and usually begin to be

confirmed by the network through a process called “Mining.” It is

essentially the process of creating new Bitcoins out of the total

Bitcoins that are designed to be “Mined” using computers. The

transactions transfer the value between the users and get recorded in

the Blockchain, ensuring that each transaction is valid.

Is Bitcoin legal money?

The legality of Bitcoins is

controversial, while some jurisdictions have express laws and

regulations to deal with Bitcoins, others still fall in gray areas. As

per a recent bill in Japan, Bitcoins and other virtual currencies have

been given legal recognition and are accepted as a mode of payment.

While in China, trading in Bitcoins come under the regulatory

restrictions imposed by People’s Bank of China.

In the U.S.A, different states have

adopted varying approaches to Bitcoins. Recently a U.S Magistrate in the

state of New York ruled that Bitcoins are not money, while a

contradictory stance was taken by a judge in Manhattan, who ruled that

bitcoins are acceptable means of payment. The Internal Revenue Service in

the United States, defines bitcoin as property rather than currency for

tax purposes. The U.S. Treasury, by contrast, classifies bitcoin as a

decentralised virtual currency.

In Russia, reportedly, Bitcoins may soon

be regulated in a bid to tackle money laundering, though, in the past,

Russia has expressed its displeasure with Bitcoins and other

cryptocurrencies. In India, as of now, no regulations have been framed

by either Reserve Bank of India or Securities and Exchange Board of

India, the two contenders, for the purpose of drafting regulations

pertaining to Bitcoins and acting as a watchdog.

In India, who ultimately acts as a

regulatory authority can only be decided based on whether the government

decides to treat Bitcoins as “Currency” or “Security/Commodity.” As per

current Indian laws, “Currency” can only be issued by the government

but the residuary powers in this regard lie with the Reserve Bank of

India which can notify “Bitcoins” as currency. After

the demonetization drive in India, the demand for Bitcoin has more than

doubled in less than two months. The Indian government has reportedly

set up an inter-disciplinary committee to regulate the Bitcoins amidst

the apprehensions that the black money hoarders may have invested into

Bitcoins.

Bitcoin trends in 2017

Bitcoins are extremely volatile in nature. While the future trends for Bitcoins can’t be predicted with utmost certainty, as per a report

published on Forbes, the market is set to show strong waves in the

favor of cryptocurrencies, as predicted by a crypto market intelligence

startup. As per the latest position, The 24-hour average rate of

exchange across USD Bitcoin markets is US$1184.87, the 7-day average is

US$1204.85, and the 30-day average is US$1080.26 confirming only the

volatility of Bitcoins.

There are possibilities that some countries may introduce an Exchange Traded Fund (ETF) to

make Bitcoin Trading easier and accessible. While a similar application

to create an ETF has been rejected by The US Securities and Exchange

Commission (SEC), the chances of other countries adopting it are not

bleak. Currently, sale and purchase of Bitcoins is a multi-step process.

Creating an ETF would make it possible for the investors to buy

Bitcoins through the stock market.

Further, In the future Blockchains, the underlying technology to Bitcoins may bring revolution in the music industry. Cryptography

could transform the music industry by using Blockchain ledgers. As per

reports, an attempt is being made to bring music distribution under the

cryptography. This can be done by adding the music to blockchain and

letting the users distribute the music by paying a sum. This can also

bring down music piracy.

To sum up the discussion, it can be said

that while Bitcoins may not replace the “Fiat Currency” anytime soon,

but there has been a phenomenal growth in the acceptance of

cryptocurrencies around the world. While the investors may still be

reluctant to invest in Bitcoins, given the high risks associated with

it, the demand for Bitcoins has grown manifold. In the end, it could be

argued that a good legal and regulatory framework for Bitcoins would

help the investors decide the viability of Bitcoins in the long run.

No comments:

Post a Comment